Home » P2P & Fixed Income Products

Peer to Peer Lending

- An emerging Asset Class for superior Fixed Returns as compared to FD and Debt MF

What is P2P?

Peer to Peer (P2P) Lending is the practice of lending money by one person to another person through an online portal for a pre-defined Purpose, Period, and Interest Rate.

How does P2P work in India?

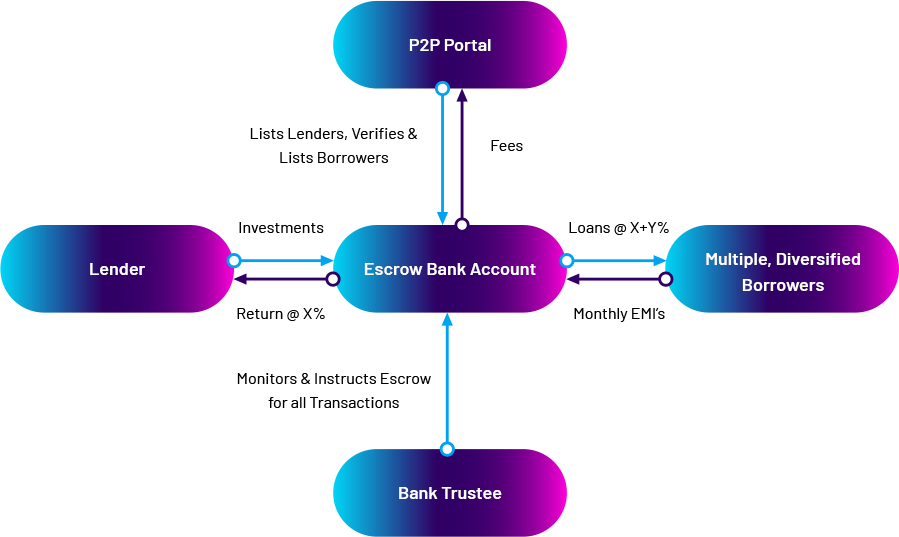

All P2P portals are registered with RBI as a P2P-NBFC.

All P2P portals are online aggregators only – they cannot lend, borrow, or control money.

All moneys flow directly from Investor to Borrow and vice versa through an Escrow Account managed by a Scheduled Bank Trustee independently.

P2P portals do the following

- List lenders after online verification process.

- List borrowers online after detailed check which involves KYC verification, Personal verification, CIBIL check, Financial verification, Social Media verification, etc covering more than 100 data points.

- List borrowers’ demographic profile, risk category (and applicable interest rate), purpose, & period of loan.

- Provide discretion to the lender to either choose borrowers or lend through an Algorithm.

- Provide monthly factsheets containing details of borrowings, earnings, and defaults by risk category; and report delays and defaults to CIBIL periodically.

- Initiate recovery proceedings from Borrowers in case of delays and defaults.

- Provide investor support.

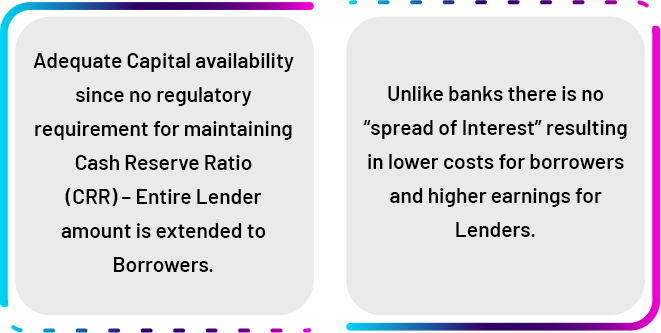

What are the advantages of P2P?

For Borrowers

For P2P Portal

For Lenders

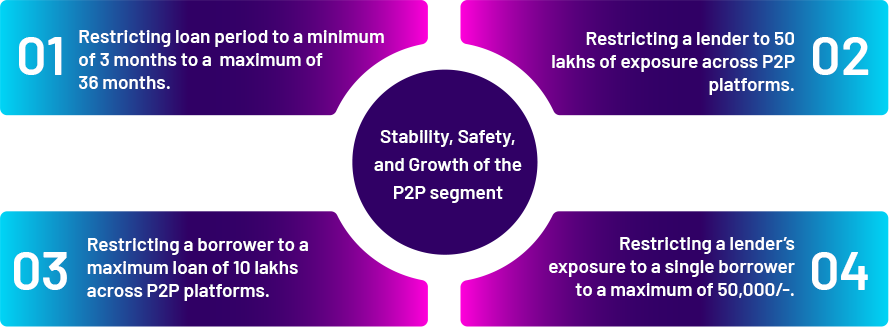

How has RBI has ensured stability, safety, and growth of the P2P segment?

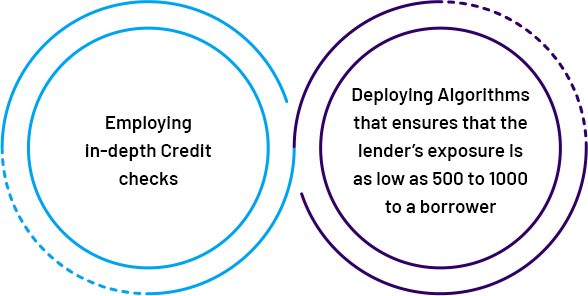

Existing P2P platforms have further de-risked the P2P model by:

Who can invest in P2P?

Individuals (including NRI through NRO account), HUFs, Firms, LLPs, Companies can invest in P2P.

Who should invest in P2P?

Persons who are:

What are the taxation aspects of P2P?

Interest on P2P is taxed at applicable tax rates in the hands of the investor.

Fixed Income Products

Based on the safety and liquidity ratings, we offer a host of Fixed Income Products that generate better returns than bank fixed deposits:

- Corporate Deposits & Debentures

- NBFC Deposits and Market Linked Debentures

- Government & PSU Bonds (including Tax Free Bonds and Bonds that qualify for Capital Gains exemption)

- Sovereign Gold Bonds